Outstanding Tips About How To Buy Drip Stocks

This plan is offered by many brokerage houses.

How to buy drip stocks. A dividend reinvestment plan (drip) lets you buy shares of stock in a company with the dividend payments from that same company. Find a company that has a drip program and offers a purchase discount. Therefore, these shares must be redeemed through the company and cannot be traded.

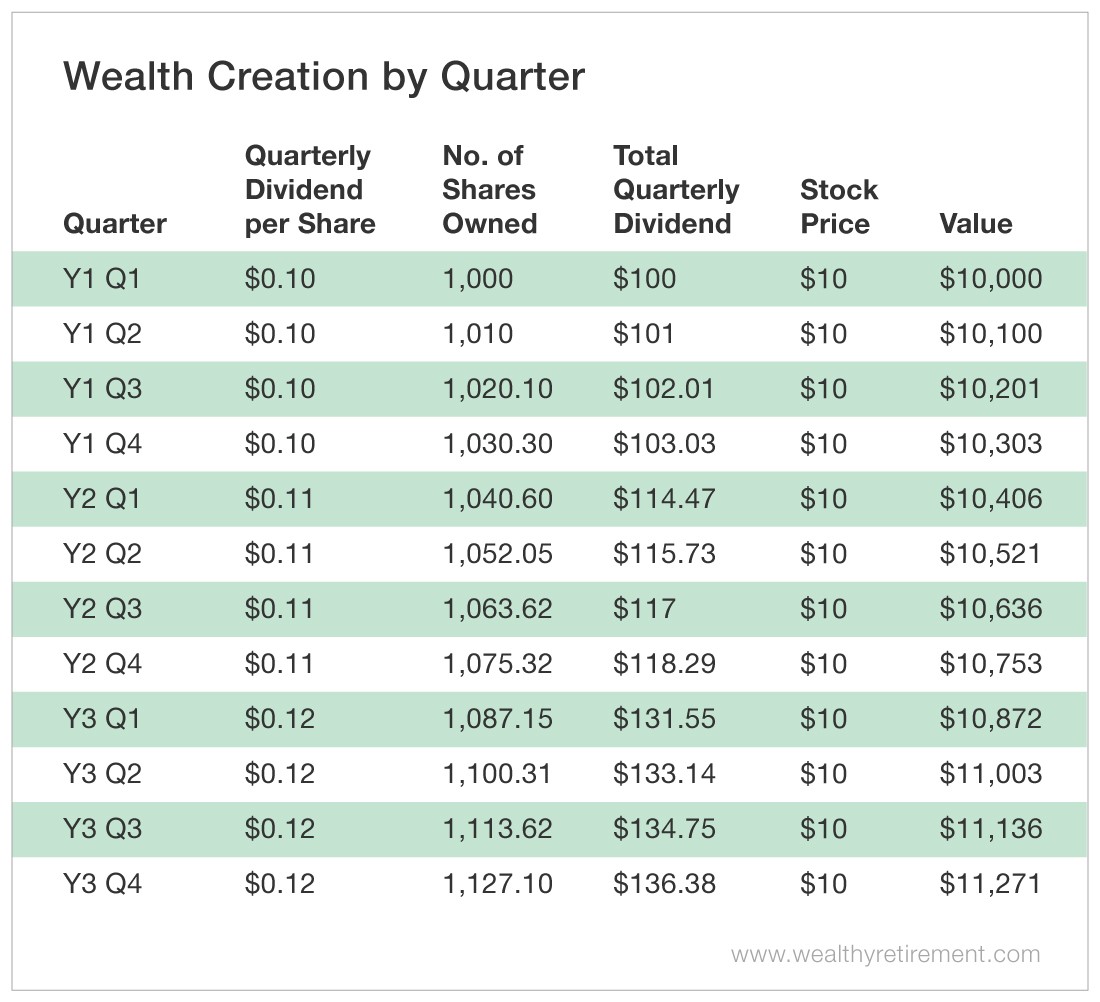

Abt) number of hedge fund holders: This calculator will show you how much your. A dividend reinvestment plan (“drip”) is a way to accumulate additional shares of stock in a company by automatically reinvesting your periodic dividends.

As per this plan, investors automatically reinvest their. If you participate in a drip in a taxable account, be aware that you will still have to pay up to 20% in taxes on your reinvested dividends. Shares purchased through a drip usually come from a company’s own reserve of stock.

Some companies offer dividend reinvestment plans (drips) that allow shareholders who already own one or more shares to reinvest dividends and possibly buy additional shares directly from. Drip stands for dividend reinvestment plan. When you choose to reinvest your dividends, each stock’s dividend payment is used to buy new shares of that same stock, at the market rate (we’ll call these drip stocks).

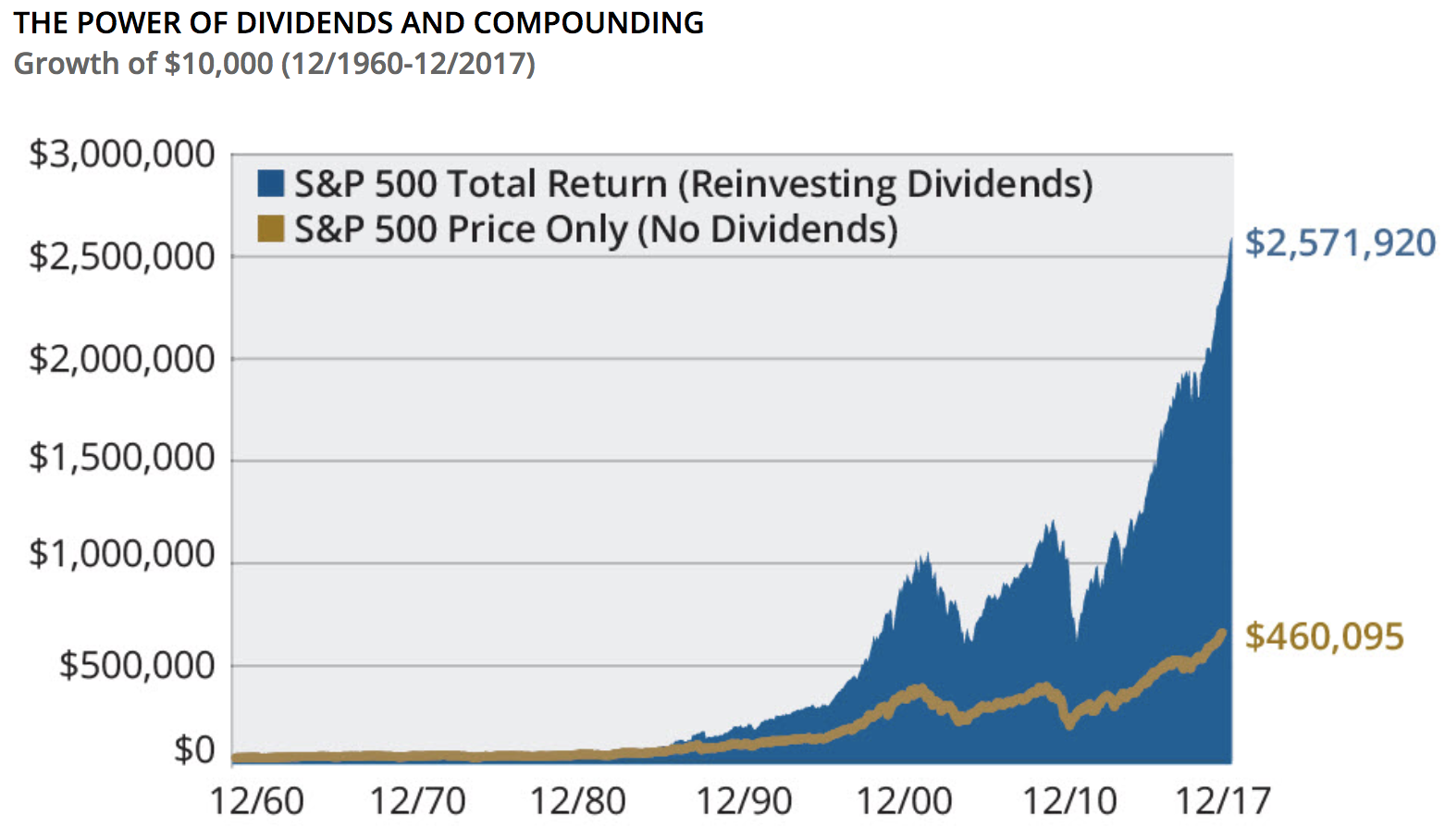

Our best drip stocks for 2021. One benefit to owning dividend stocks is the growth that comes when shareholders reinvest the dividends they receive. Albemarle is the largest producer of lithium and second largest.

Purchase enough shares or units so you have enough to drip at least one whole share or unit. Pep ), and johnson & johnson. Depending on your online brokerage account, you should find an option to toggle the drip setting.